One of our primary goals at The Wealth Group is to help our clients achieve financial independence at a younger age than most Americans. Financial independence doesn’t necessarily mean you retire and quit working; it just means you no longer need to keep working or saving money for the rest of your life.

But for our clients in their 50s and early 60s that begin to contemplate retirement, one of their biggest concerns is healthcare costs. Before going on Medicare, buying private health insurance is certainly expensive.

The best way to combat fears about healthcare costs is to build these costs into your financial plan — which we do for you here at The Wealth Group. You can go to eHealthInsurance to price out private health insurance plans. While it’s painful to consider $1,000 per month premiums (or higher), we can build that added expense into your plan and make sure the numbers still work for early retirement. If you’re five years away from Medicare eligibility, we build in the anticipated costs for those five years of expensive private health insurance.

Another great option to consider is a faith-based healthcare sharing program. Three of the seven families represented here at The Wealth Group are already on such programs (two families at Christian Healthcare Ministries and one family at Samaritan Ministries). These programs have the potential to significantly reduce your out-of-pocket healthcare expenses — when compared to traditional health insurance.

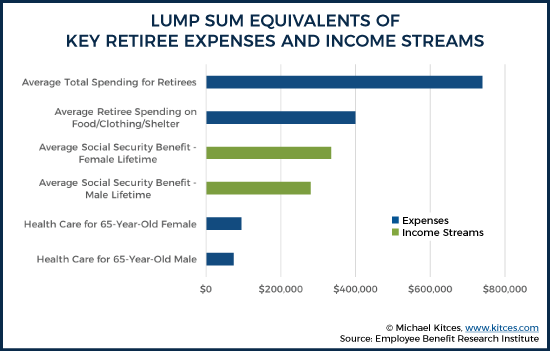

Switching gears, how about the lifetime healthcare costs anticipated for a typical 65-year old retiree? We have written previously about the needless scare tactics employed by journalists that state retirement healthcare costs in a lump sum figure (e.g. you will spend $275,000 on healthcare costs in retirement!!).

But when you stack lump sum healthcare costs next to other lump sum retirement figures, it’s not so scary:

What does this mean to you, our client?

Let’s have a conversation about how rising healthcare costs will impact your financial future. These costs are significant, but they aren’t a retirement-killer.