The Wealth Group – Austin B. Colby & Associates is a Securities and Exchange Commission registered investment advisor. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities, and past performance is not indicative of future results. Investments involve risk and are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed here.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

MINNESOTA

14850 SCENIC HEIGHTS RD, STE 100 EDEN PRAIRIE, MN 55344

(952) 937-9423

TENNESSEE

725 COOL SPRINGS BLVD, STE 445 FRANKLIN, TN 37067

(615) 395-8600

VIRTUAL OFFICE NATIONALLY VIA ZOOM

At The Wealth Group, I enjoy getting to know our clients and their families as well as seeing the joy on their faces and their peace of mind as they start to implement our suggestions and seeing their financial dreams come into fruition.

I am very goals driven. A few years back I had a dream to play professional golf and through hard work, self-belief, and dedication I saw some success, winning multiple mini tour events. I want to provide that same drive (golf pun) and determination while working with our clients as they pursue their dreams and be there with them as we celebrate the victories together.

Success with finances is just like success on the golf course—building a plan around your specific needs, abilities, and goals; then starting good behaviors to help facilitate that plan. For example, good financial behaviors would include a healthy savings/investing rate and paying down debt. It helps having that teammate, coach, or advisor to bring knowledge and encouragement, consistently and at pivotal points, in your journey. That is where The Wealth Group comes in.

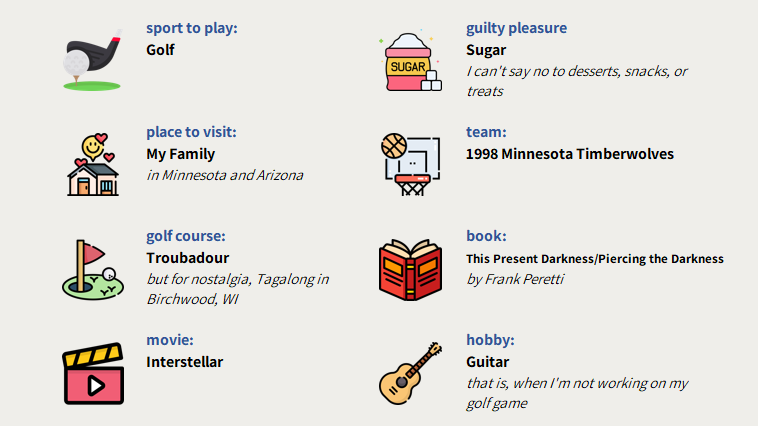

When I am not at The Wealth Group, you will find me doing one of three things. I am usually working hard on my golf game (I refuse to let Dan, Ben, or Austin beat me). If I am not at the golf course, I am usually singing in the church choir or playing my guitar. I also enjoy spending time with the Colby family. There, we are either jumping on the trampoline, bumping the volleyball around, working out, swing dancing, or making music.

With over two decades as a business owner, investor, and entrepreneur, I’ve experienced the ups and downs of building wealth firsthand. After 22 years of running my own business, I was fortunate to retire and step into a new chapter—helping others pursue financial independence and long-term stability.

My wife and I became clients of The Wealth Group back in 2006. Like many driven entrepreneurs, I didn’t always follow the plan perfectly—chasing other ventures instead of consistently investing. Some ventures paid off, others didn’t. A turning point came over a decade ago during a candid review with Austin Colby -owner of The Wealth Group – who showed us that while we had strong assets on paper, we were highly leveraged and short on liquidity. That honest moment reshaped how I view money, risk, long-term wealth planning, and financial independence.

In 2021, I joined The Wealth Group to help motivated families, entrepreneurs, and business owners navigate the same challenges I’ve faced—bringing experience, perspective, and a heart to serve.

Outside of the office, I’m a husband, dad to four, and a proud grandpa. My wife and I are very involved at our church, and I’m on a lifelong quest to become a scratch golfer.

Bachelor of Science in Business Administration and minor in Christian Studies from North Central Universit

“I have always had an interest in personal finance. Having a plan and setting goals for your financial life enables you to accomplish things that otherwise would never be possible. A thousand small steps in the right direction can lead to a life of stability and ability—The Wealth Group exists to help plot that course and keep our clients on track.”

Even as a young adult, keeping her finances in order and planning for the future has allowed Paige to experience wealth as a blessing rather than a stressor. She wants people to know that same freedom, especially when life gets complicated.

I enjoy helping our clients make good decisions with their money. It’s rewarding to watch our clients build wealth with us at their side. When I see a young family cross the $1 million net worth mark — after starting with our team with a net worth of $200,000 — it’s an awesome feeling.

As our clients continue to focus on the things they can control, such as paying down debt and adding money to their investment portfolio year after year, I have noticed that it becomes easier to stomach the (inevitable) bear market. Over my time at The Wealth Group, I have learned that good financial behaviors never go into a recession.

When I’m not at The Wealth Group I enjoy spending time with my wife and three children. Together we like to be outdoors, play sports, and be active participants at our church.

“I am passionate about my work because I think it is important to make wise, informed decisions with our finances as it permeates into all aspects of our lives. Just as people strive to maintain balance in their overall lives, financial wellness and understanding in your personal life is just as important. ”

“I have realized there are so many people in the world today who are unsure of how to save or plan for the future. They live paycheck to paycheck and think debt is normal. We get to help people realize that there’s a different way to live. We get to help people who feel hopeless finally find a clear path for the future while taking control of their finances for the first time. When people are proactive rather than reactive, it’s amazing what can be accomplished.

Karie’s main role is managing the onboarding process for new clients. She works hard to ensure a seamless transition and to make all clients feel welcome and cared for. As the Director of Client Services, she oversees the Client Services team, plans client events, processes monetary transfers, handles paperwork for clients and helps to manage the day-to-day operations of the office.

“I love being able to see and contribute to the confidence in the families we help when they know they are taking the correct steps towards financial independence. I truly enjoy building relationships with people. The work I do with The Wealth Group gives me the opportunity to do this by building a relationship that will last a lifetime.”

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER ™, and CFP® in the U.S.

“I love working alongside the people at The Wealth Group. Additionally, my younger brother (and now boss) and I have wanted to work together for years. When the opportunity arose within The Wealth Group I jumped at the chance. I have always had a passion for personal finance and investing; the transition into this investment-focused role was a natural one for me.”

Developing and stress-testing the firm’s asset allocation models is a passion of Adam’s. You may often find him assessing risk metrics for client portfolios and the broader global markets as well as trading and rebalancing client portfolios.

Investments & Wealth Institute TM (The Institute) is the owner of the certification mark “CIMA” and “Certified Investment Management Analyst.” Use of CIMA and/or Certified Investment Management Analyst signifies that the user has successfully completed The Institute’s initial and ongoing credentialing requirements for investment management professional.

From childhood, I was strongly interested in working hard, making money, and most importantly, saving money. Today, I use that passion to empower our clients to succeed with their money. A lot of people experience unnecessary stress and anxiety in their financial lives.

After college, I worked in a large bank and began investing on my own for the first time. I remember plugging numbers into a Roth IRA Calculator and realizing the power of compounding from an early age. I was amazed at how [seemingly] easy investing was…not realizing that bear markets are what make investing challenging. A few years into my career as a financial advisor, the Great Recession (2007-2009) hit, and I gained a lot of crucial experience in a short period.

Those lessons from the Great Recession will stick with me for the rest of my life. I learned not to over-extend myself on real estate, to never sell out of stocks during a bear market, the power of being 100% debt-free (including no mortgage), and also the opportunities in stocks that arise from the ashes of a deep bear market.

Proverbs 11:14 says, “Where there is no guidance, a people falls, but in an abundance of counselors there is safety.” We aim to be those counselors that provide knowledge and safety for our clients.

A good financial advisor should have the heart of a teacher. Through our relationship, we aim for our clients to grow in knowledge and mastery over their finances. We want them to be the driver of their financial plan, with us as their sidekick/coach to help them realize their plans and goals.

I have been quoted as a financial expert in Fox Business, U.S. News & World Report, Yahoo! News, GOBanking Rates, Lifehacker, and Business Insider.

More important than my role at The Wealth Group is my position as a redeemed son of God, husband to Krista, and father to five children.

“I want people to succeed at life and that includes guiding them to achieve sound money management. I enjoy helping individuals and businesses make beneficial decisions in regards to money and investment management. Long range planning is one of my professional passions and moving people from the thought of retirement to the reality of retirement is something I enjoy assisting our clients with.”

Paul has more than 25 years of experience advising business owners and affluent individuals about their finances. Paul has achieved the CERTIFIED FINANCIAL PLANNER™ designation. Being a CFP® professional enables him to help clients focus on what is important to them. He has also earned the Chartered Retirement Plan Counselor (CRPC®) designation, which demonstrates his expertise in the area of retirement financial planning for individuals.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER ™, and CFP® in the U.S.

“I believe every family can achieve their financial goals if the path to do so is clear. This work of building paths and guiding clients along those paths is my passion, and it brings me tremendous joy. After twenty years of doing this, I am more excited today than ever about helping families with their finances. Helping one family at a time make good choices makes a difference. I believe that wholeheartedly and am thankful for the opportunity to serve so many people in this capacity.”

Austin is the owner and visionary behind The Wealth Group. His #1 responsibility is to lead our team in devotion to the mission: providing quality financial planning and investment management to the firm’s clients.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER ™, and CFP® in the U.S.