Social Security

- Life expectancy in 1900 was 47. In 1935 (when the Social Security program became an active policy), life expectancy had increased to 61. The Social Security full retirement age (FRA) at that time was 65, meaning that over 50% of Americans were never intended to receive any sort of retirement benefit from the Social Security program. Life expectancy is up to 78.7 as of 2017. (source: U.S. Census Bureau).

- As further confirmation of the intended usage of the program, the official name of the program is “Old-Age, Survivors and Disability Insurance Program” (OASDI). It was primarily designed as an “old-age pension” – and only meant to be a partial supplement of income.

- Today, over 45,000,000 Americans over age 65 receive Social Security benefits (source: SSA.gov).

- According to a 2015 Retirement Confidence Survey, 63% of Social Security recipients say it is a major source of income.

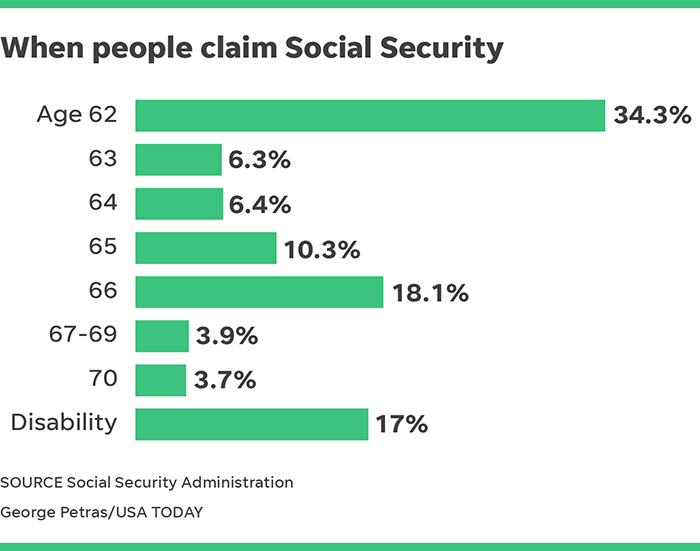

- 57% of recipients take benefits before full retirement age (FRA), which means they accept a permanent reduction of their stated benefit (source: Social Security Administration).

- Only 4% of recipients wait until age 70 to file – the age at which benefits are maximized (source: Social Security Administration).

- The average retirement age for men has stayed between age 64 and 65 over the past 50 years. The average retirement age for women has increased from 52.5 to 62.3 over the past 50 years. (source: U.S. Census Bureau)

- 81% of Americans say they don’t know how much money they’ll need to fund their retirement (source: Age Wave/Merrill Lynch 2017).

What does that mean to you?

A big part of building a sound retirement plan is better understanding how much money you’ll need in retirement. While Social Security will likely be a part of your plan, it is still important to build an investment portfolio that will help sustain your lifestyle in retirement.

A fun exercise to give a general idea of the size of portfolio needed to fund your lifestyle:

- Take your current annual spending number (another option is using your annual after-tax income) and subtract your future Social Security benefit, and multiply that number by 20-25.

- Example: $100,000 of annual spending minus $30,000 of future Social Security = $70,000 of needed income. Multiply that by 20-25 = $1,400,000 – $1,750,000 needed portfolio size to fund your lifestyle in retirement.

Because The Wealth Group, Austin B. Colby & Associates is independent of Raymond James, the expressed written opinions above are our own and not necessarily reflective of Raymond James’ opinions.

The information has been obtained from sources considered to be reliable, but we do not guarantee the foregoing material is accurate or complete.