The Wealth Group exists to help our clients make better decisions with their money. Our clients’ financial behaviors should look different from their neighbors. Making better decisions around money leads to greater success with money; ergo, wealth is built. Building wealth is not magic; it’s not the result of cosmic forces. It’s a known formula, consistently followed over a long period of time.

Every year since 2000, Vanguard releases a report called How America Saves. The 2016 report was released last summer; it is 110 pages and chock-full of fascinating data. Well, fascinating to nerds like us.

Vanguard now has recordkeeping statistics for 4,400,000 participant accounts in defined-contribution plans (e.g. 401(k) accounts). So, it’s a great sample size to represent how ordinary Americans are saving for retirement.

There are now more than 94 million Americans covered by defined-contribution plan accounts (such as 401(k)s and 403(b)s), with assets over $7 trillion — as of year-end 2016.

Here are just a handful of the interesting facts unearthed in Vanguard’s report:

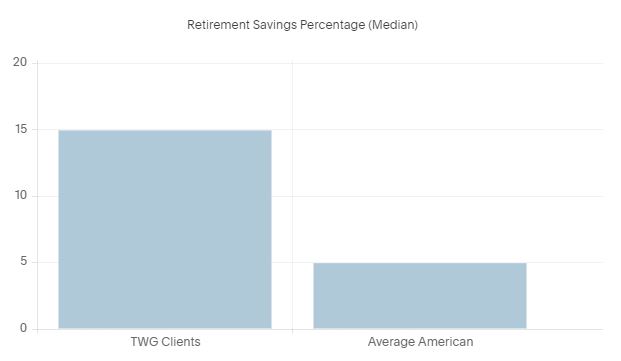

- The median participant deferral rate is 5% (i.e. employees contribute 5%, on average). This number excludes the employer match. Contrast that number with the median retirement savings rate of 15% for our young clients at The Wealth Group. That means our young clients (under age 45) are saving three times as much for retirement as the average American.

- Just 18% of the plan participants are saving more than 10%.

- 65% of the plans offer Roth contributions.

- Within the plans that offer Roth contributions, a paltry 13% of the participants even use the Roth option.

- More than 700,000 of the 4,400,000 (16%) accounts held an outstanding loan on their retirement account.

- The median employer match was 4%.

What does this mean to you, our client?

If you are already saving 15% or more of your income toward retirement, congratulations. You are crushing it.

If you are below the 15% retirement savings clip, let’s talk about how we can make the next step. The next step could be as simple as a 2% increase in your savings rate. Or, maybe we need to pull the training wheels off and dive in to a 15% savings rate.

Source: Vanguard study

Because The Wealth Group, Austin B. Colby & Associates is independent of Raymond James, the expressed written opinions above are our own and not necessarily reflective of Raymond James’ opinions.