One of our primary goals as financial advisors is to help our clients put good financial behaviors into place in their lives.

Consider some of the most commonly-used phrases about finance and investing. We have heard these phrases so many times that we begin to tune them out.

You have heard these phrases many times in your life:

- “Pay yourself first.”

- “The power of compounding.”

- “Diversify your investments.”

- “

Money is cheap right now.” (nope; we don’t think that way) - “

Debt is the greatest motivator.” (a relative told me that when I was 21; it’s lousy financial advice) - “Automate your finances.”

The phrases I didn’t strike-out above are good pieces of advice, but they are so generic as to be ignored or met with a yawn by most of us (except for my beloved engineer friends, who think through everything – looking at you, Tom and Nick).

So, how can we make them specific – to apply them to your own personal financial situation?

Today I am focusing on automating your finances. Here are 5 practical ways to do that:

1. Divert $500 from every paycheck into an after-tax investment account (via direct deposit).

If part of your paycheck doesn’t go into your checking account, it doesn’t get spent. This is why the 401(k) was such a great innovation when they debuted in 1978. Out of sight, out of mind.

Did you know that your paycheck could be separated into multiple bank/investment accounts via direct deposit?

An after-tax investment account is one of our keystone Indicators of Wealth. For our clients that can accumulate investment holdings in a non-retirement account, these folks typically have the most comfortable retirements.

Synonyms for this type of account include: brokerage account; taxable investment account. It’s not an IRA, not a Roth IRA, not a 401(k). Think of it like checking account money, except the funds are invested in good old-fashioned stocks and bonds.

2. Establish automatic additional principal payments on your mortgage.

Many of our clients endeavor to pay extra on their mortgage. But we have seen plenty of evidence that automating this step is crucial. For clients that attempt to do this manually (i.e. they log in every so often to pay extra on their mortgage), they often end up only doing so a couple of times a year.

Contrast that with our clients that have their lender automatically pull an extra $100 (or more) from their bank account to pay down the principal balance. When it’s automatic, it always happens! It’s fail-safe.

With a small amount of effort, you can easily knock 5-10 years off your payoff schedule on a 30-year loan (though you know we always recommend 15-year mortgages or less to our clients in the first place).

3. Direct deposit one spouse’s Social Security (or pension) into your investment account – rather than your bank account.

Through hard work and disciplined savings during their working years, some of our clients don’t need 100% of their Social Security income (or pension income) to live on in retirement.

A few of our clients deposit one spouse’s Social Security income directly into their investment portfolio. Rather than earning 0.001% in the bank, they can generate growth on those dollars over time in their portfolio. It’s a great way of building an increased margin of safety during retirement.

4. Deposit money monthly into a college savings account (529 or UTMA).

I have written before about saving for my daughter’s wedding (she’s only 6 years old). We opened a custodial account (called a UTMA here in Minnesota) shortly after she was born. We deposited $25 every month into that account. Earlier this year, I kicked that up to $50/month.

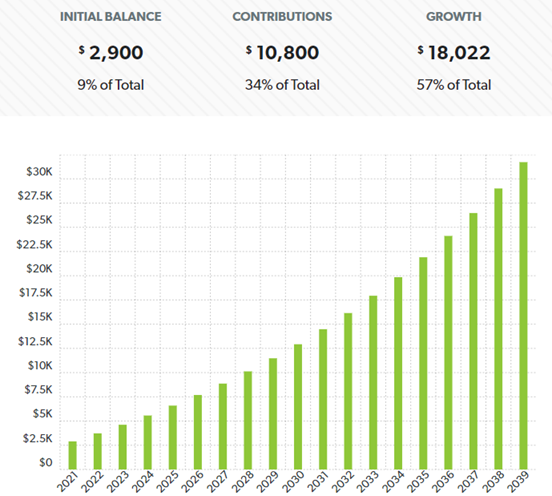

That custodial account now has $2,900 in it. By the time Evelyn is in her mid-20s, the account could have over $30,000 in it (with a 7% annual return). If she and her groom-to-be want to spend all of it on their wedding, they can do so.

Even better, they could spend “just” $10,000 on the wedding, then put the other $20,000 toward the down payment on a home.

This is a hypothetical example for illustration purposes only. Actual investor results will vary.

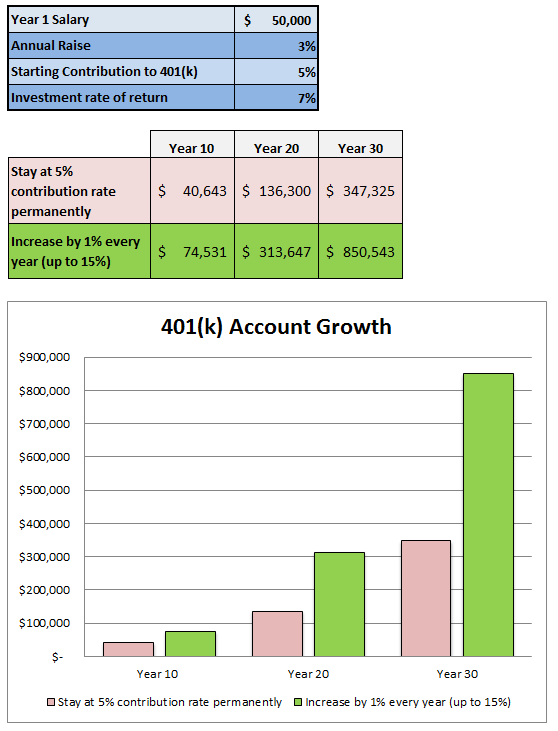

5. Establish automatic annual step-ups in your 401(k).

Many 401(k) plans enable automatic 1% step-ups annually in your contribution percentage. This can be done in 2 minutes by logging in and checking the box for automatic step-ups.

In any given year, a 1% increase in your 401(k) contributions won’t feel like much – and that’s a good thing. It won’t pose a great challenge in your family’s cash-flow, but it can add up to hundreds of thousands of dollars in additional wealth for retirement.

Check out the following example:

This is a hypothetical example for illustration purposes only. Actual investor results will vary.

Try to put one of these five ideas into practice in your financial life today. What’s the worst that can happen if you try it out for 3 months? You can always change back to the way things were before.

Any opinions are those of The Wealth Group, Austin B. Colby & Associates and not necessarily those of RJFS or Raymond James. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Diversification does not ensure a profit or guarantee against a loss. 401(k) plans are long-term retirement savings vehicles. Withdrawal of pre-tax contributions and/or earnings will be subject to ordinary income tax and, if taken prior to age 59 1/2, may be subject to a 10% federal tax penalty. As with other investments, there are generally fees and expenses associated with participation in a 529 plan. There is also a risk that these plans may lose money or not perform well enough to cover college costs as anticipated. Most states offer their own 529 programs, which may provide advantages and benefits exclusively for their residents. The tax implications can vary significantly from state to state.