Today’s post is written by Paige Knier, The Wealth Group’s intern. Paige will be graduating this fall from North Central University in Minneapolis with a bachelor’s degree in Business Administration, which she is prepared to put to work while deciding on a career path after college. She enjoys being with friends, reading, and living in the city. Due to being raised by a parent in the financial planning industry, Paige is a fan of smart financial decisions.

Buying a house is a big deal. It’s an opportunity to find the home that you’ve always imagined: the perfect size, in the perfect location, with the perfect potential to make it into a place where your family can enjoy many years together. It’s an exciting step! But you know what else is a big deal? Mortgages.

Thoughts of mortgages can take some of the fun out of house-hunting. There are a lot of considerations when it comes to financing your home purchase. How much should you put down? How much can you prudently borrow? And then there is the question we’ll consider today: which loan type is right for you? Is there “one best option” for all future homeowners? It can be overwhelming to juggle all of the decisions that come with choosing a mortgage, but it doesn’t have to be.

Let’s compare and contrast the two most common mortgage terms: 30 and 15 years.

The bureau of labor statistics reports that between the years of 2004 and 2014, 61.5% of homes were purchased using a 30-year fixed rate mortgage, while only 14.6% of buyers opted for a 15-year mortgage.

You probably already know where The Wealth Group stands on this one: we are major advocates of the 15-year mortgage. As it turns out, millionaires in America are also big proponents of the 15-year mortgage. In a study of over 10,000 American millionaires, Ramsey Solutions found the average millionaire paid off their house in 11 years – and that 67% of millionaires live in homes with paid-off mortgages.

30-year mortgages require a lower monthly payment on the principal each month. However, they carry higher interest rates to account for the increased life of the loan. On the other hand, the monthly payments on a 15-year mortgage are higher, typically about 1.5 times those of the 30-year mortgage, because the same amount of principal must be paid off in half the time. In spite of the higher payments on the 15-year mortgage, the borrower will save a tremendous amount of money through paying significantly less interest over the life of the loan (as compared to the 30-year mortgage).

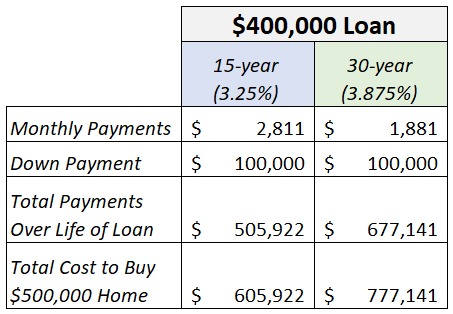

At the time of this writing, 30-year mortgages come at a fixed rate of 3.875%, while their 15-year counterparts have a current rate of 3.25%.

Suppose that a hopeful homeowner is looking to buy a $500,000 home with a 20% down payment – leading to a $400,000 loan amount.

Note that the monthly payment for a 15-year mortgage in this scenario is 50% higher than that of a 30-year mortgage, but the overall cost is almost 34% lower.

What about home purchasers that are not buying their “forever home”? Does the 15-year mortgage still make sense for families with a shorter expected timeline in their home? Absolutely. Because a 15-year mortgage begins paying down principal much more aggressively than the 30-year mortgage, the home buyer has a significantly lower mortgage balance when selling their home after a relatively short period of time (e.g. 5 years).

Consider this example:

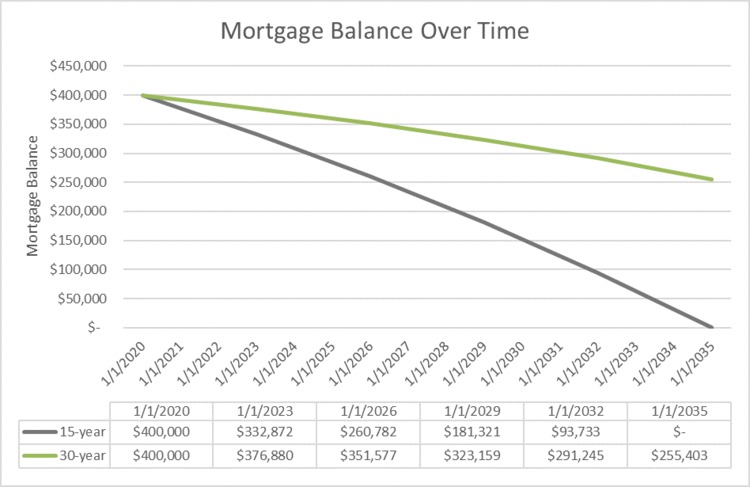

Two buyers start $400,000 mortgages on January 1, 2020. One takes out a 15-year mortgage at 3.25%; the other takes the 30-year mortgage at 3.875%. The table below compares their mortgage balances at intervals of the 3, 6, 9, 12, and 15 years that follow.

By the start of the year 2035, the owner of the shorter loan is debt-free. The second borrower still owes more than $255,000!

What does this mean to you, our client?

We tell our clients to “begin with the end in mind” (hat tip: Stephen Covey). If your goal is to eventually be 100% debt-free, why not get there sooner rather than later? While the monthly payments will be higher along the way, getting your debt entirely paid off in 15 years enables you to build wealth more quickly after that time.

Because The Wealth Group, Austin B. Colby & Associates is independent of Raymond James, the expressed written opinions above are our own and not necessarily reflective of Raymond James’ opinions.