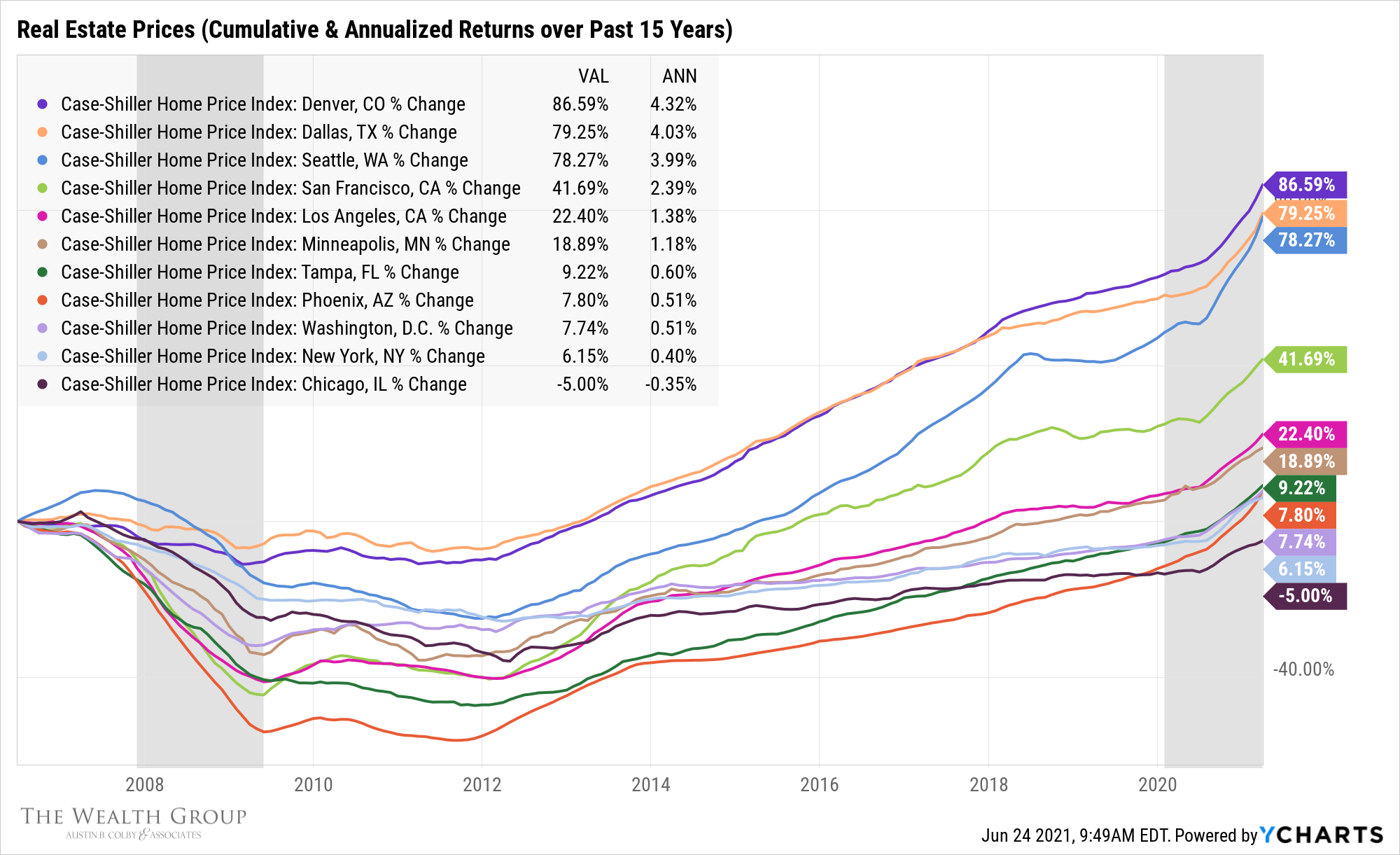

I was talking with a client recently about a home he owns in a major US city (not Minneapolis). I was curious about what the historical price appreciation has been in his market, so I pulled some data on the city.

The information my search produced fascinated me. I then began wondering how other US cities’ real estate has performed over recent periods.

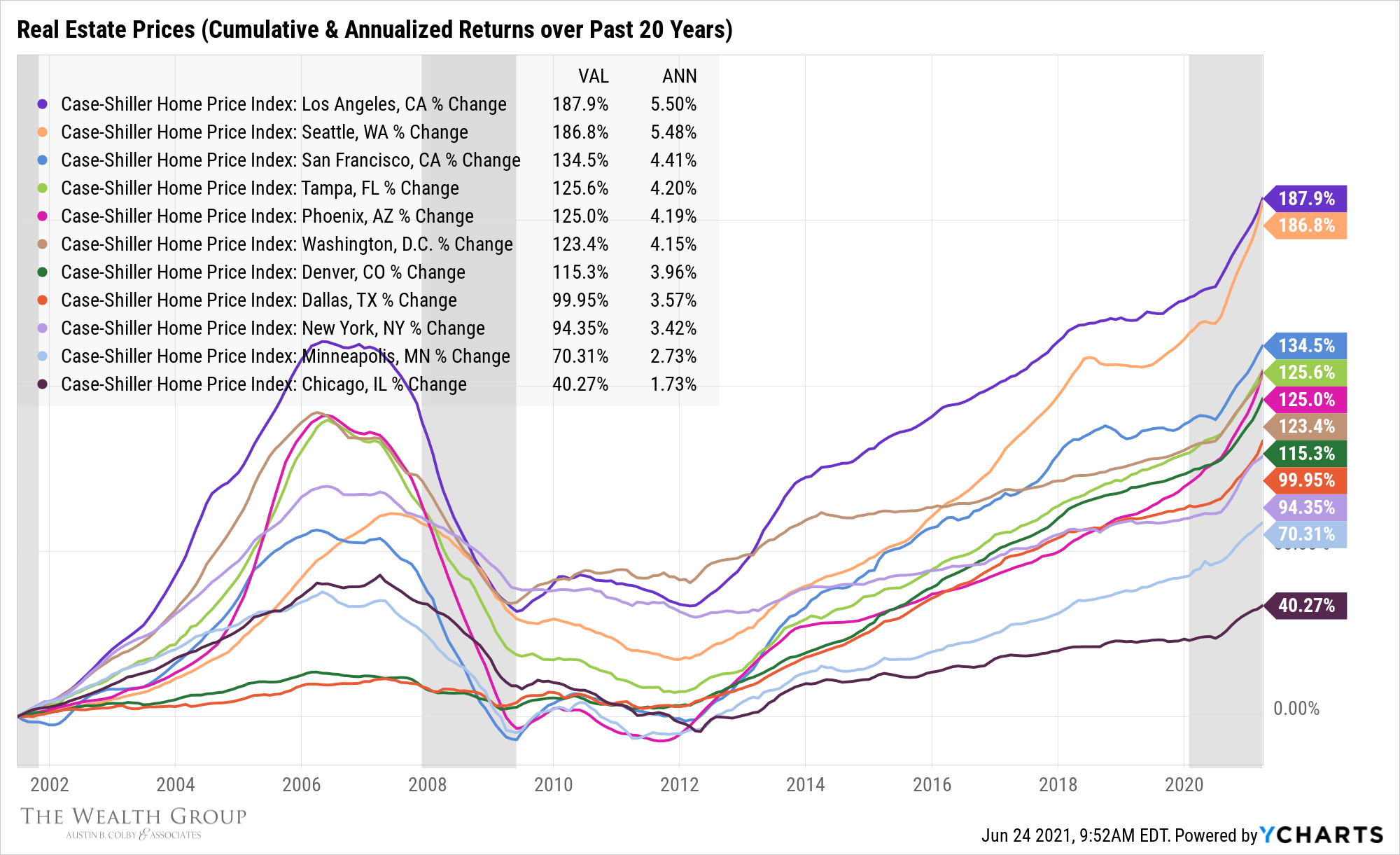

Two observations appear from the data:

1) Location matters (duh).

2) Timing matters. Over the past 15 years, Los Angeles real estate has increased at a paltry 1.4% annually. But if we look at the past 20 years, we end up with Los Angeles being the best performer at 5.5% annually.

This data also highlights how meager the returns of residential real estate have been — at least relative to US stocks. But there are some counterpoints that make real estate more compelling:

- We all need a place to live, so we might as well buy vs. rent (assuming you have a long time horizon for staying put).

- Through the use of debt, “leverage” is obtained. When you put 20% down on a $500,000 home, your appreciation (or depreciation) occurs on the full $500,000 asset — not just on your cash input of $100,000.

- If a $500,000 home value grows at 4% per year for 10 years, it’s worth $740,000 after 10 years. “My home value grew by $240,000!”

- When investing in stocks, it takes a lot of time to build up $500,000 in an investment portfolio — because you are not using leverage on the assets.

- So even though stocks have historically grown at a much faster clip than residential real estate, the power of compounding in stocks takes a lot longer to materialize. For many folks, they really don’t see this investment portfolio appreciation until their 50s or even 60s — right about the time when they begin to think about retirement.

Real estate can be a good store of value over time, helping to combat the pernicious effects of inflation and money-printing by the government. But real estate also has significant carrying costs (property taxes, insurance premiums, repairs and maintenance, etc.), and is illiquid.

That illiquidity is so important to remember. The appreciation of your home value looks good on a net worth statement, but it doesn’t mean anything until you sell the home. And when you sell the home, you are most likely buying a new home that has also experienced similar appreciation over time — so it’s a net-nothing for your family.

What does this mean to you, our client?

In a hot real estate market, it becomes increasingly tempting to “stretch” for a home that costs much more than you would have dreamed of spending just 3-5 years ago. To ensure long-term financial peace, we should aim to keep our purchase price in line with our overall financial picture.

Instead of asking a mortgage broker how large of a loan you can qualify for, we hope our clients will first talk to us as they begin looking at homes. We start by looking at your total liquid portfolio (all investment accounts), your household income, your age, your desired Financial Independence (“retirement”) date, and a number of other factors, before arriving at a recommended price range that fits with your situation and goals.

A simple rule of thumb: by retirement-age (whenever that will be for you), aim to have an investment portfolio that is at least 4 times the size of your residential real estate holdings. For example:

- A couple that owns a home worth $600,000 and a cabin worth $400,000 has $1,000,000 of residential real estate.

- They should attain a liquid investment portfolio of stocks and bonds that is worth at least $4,000,000 by the time they retire/reach Financial Independence.

If you don’t work with us but are interested in building a solid financial future for you and your loved ones, click here to schedule an introductory call with me.