tl;dr version: dividend stock investing isn’t inherently good or bad, but it faces an uphill battle in our current growth-stock dominated environment.

I have experimented with dividend-focused investing at times through my 20-year investing career. Who doesn’t love the idea of a juicy cash yield hitting your investment account every quarter?

Dividends were even etched in our collective consciousness through many [never-ending] games of Monopoly in childhood.

In this article, I aim to provide a level-headed view of both the challenges and the upsides of dividend investing.

The Challenges of Dividend Investing

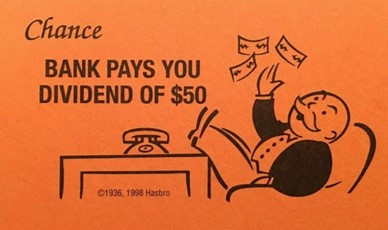

1. The biggest obstacle to dividend-based investing today is that many of America’s largest (and best-performing) companies pay little to no dividends. When looking at the entire US stock market today, the annual dividend rate is just 1.29%.

A $1,000,000 stock portfolio generates just $12,900 of annual dividend income.

From 1970-1990, stock dividends averaged 4.03%. During that period, living off your income alone was feasible, particularly since bond yields were healthy (i.e., not low).

As equity-based compensation to employees increased in the 1990s (and through to today), stock buybacks needed to grow in order to prevent share dilution of pre-existing shareholders.(1) With buybacks increasing and interest rates declining, dividends moved lower.

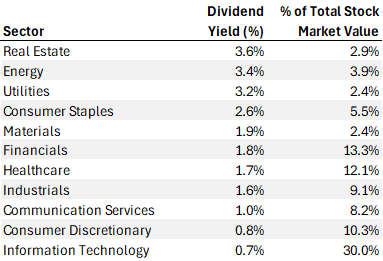

If you’ve been investing in higher dividend-paying stocks over the past 10 years, you have likely trailed the overall US stock market in total returns by a wide margin. The technology sector has dominated US stock market performance for a while now, and this sector also pays some of the lowest dividends amongst the 11 sectors of the US market.

You may earn a nice 3-4% yield on your stocks each year (by focusing on sectors that pay higher dividends), but if the share prices of those companies are not appreciating as quickly as lower-yielding stocks, your total return (performance) will lag.

The four sectors paying the highest average dividends only comprise 14.7% of the total US stock market value today:

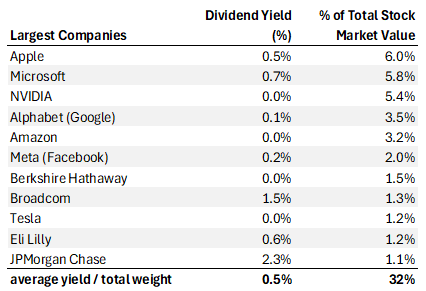

To further illustrate this, the 10 largest companies in America comprise more than 32% of our total stock market value – and they pay an average dividend yield of just 0.5%:

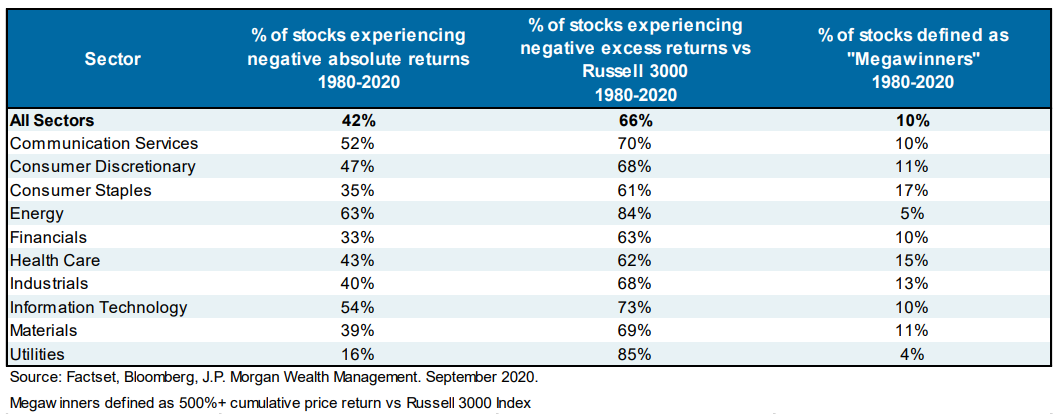

2. A second challenge is one that faces any stock-picking strategy: most individual stocks don’t perform great.

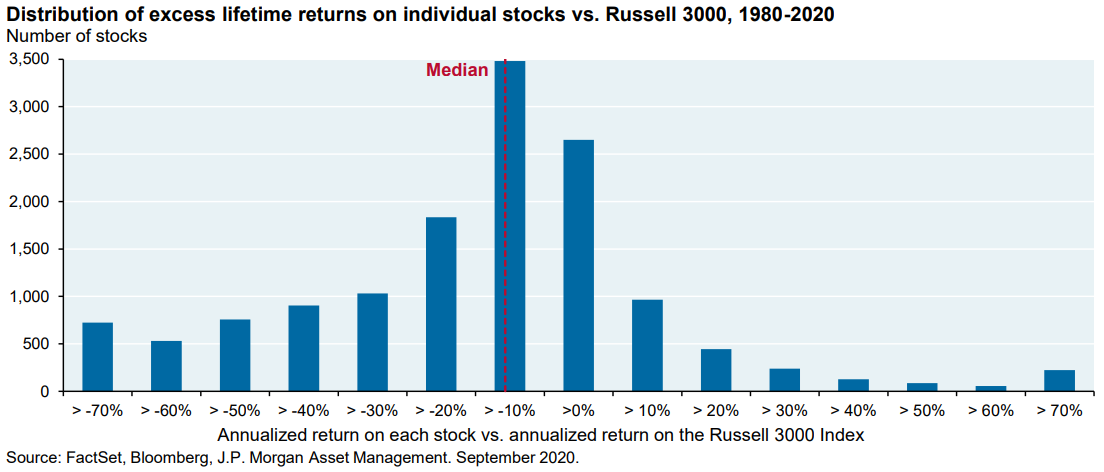

Over the past 40 years, more than 40% of all individual stocks had negative returns.

Take a minute to reflect on that. If you picked a single individual stock over the past 40 years, you had a 40% chance of losing money overall. And you had a 2 out of 3 chance of performing worse than the broad market.

The explanation for this phenomenon is that “Megawinners” drive the entire stock market higher, more than compensating for the many stocks that experience negative total returns over their history.

The Upsides of Dividend Investing

1. Collecting income from your stock investments feels good. In today’s environment, a retired investor with 70% stocks and 30% bonds can easily collect 2.5% – 3% of combined annual income from stock dividends and bond interest. A $2,000,000 portfolio paying out $60,000 in annual dividends and interest is not too shabby.

While that income stream is meager compared to the past, it’s significant enough that some of our clients can live off their investment income alone – when paired with Social Security benefits.

If you only need the income from your investments, you can avoid touching the principal of your portfolio. That is, you don’t have to sell any shares of stocks/bonds.

2. It’s possible that higher dividend stocks will offer better downside protection during down markets. But even that is not guaranteed, as every bear market is different (no one can predict with consistency which sectors will shield investors best in each bear market). In the COVID-induced bear market, every stock got clobbered: there was nowhere to hide.

When tech stocks sold off in 2022, dividend-focused strategies offered great downside protection.

But when markets rallied in 2023 and so far in 2024, dividend-focused strategies have lagged the broad market.

How We Do It

There are two primary styles of dividend stock investing:

- Buy companies that currently pay a high dividend.

- Buy companies that have historically grown their annual dividends over time (even if their current dividend yield is not high).

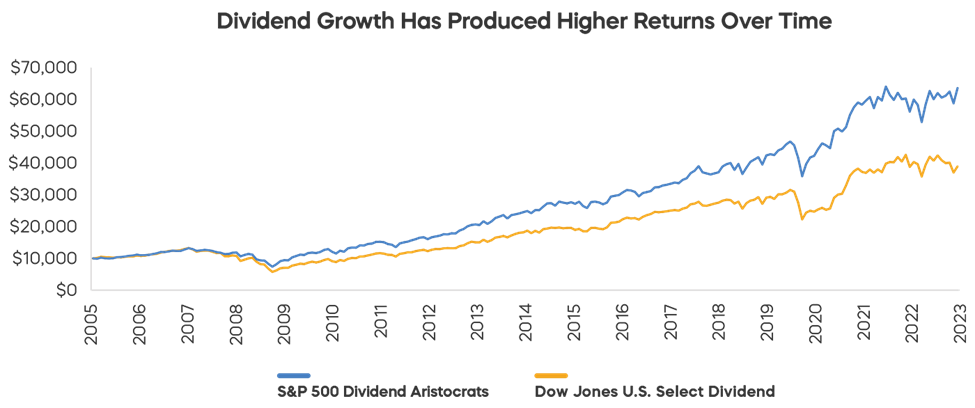

We have used that second strategy (the dividend growth model) – due to superior relative performance over time:

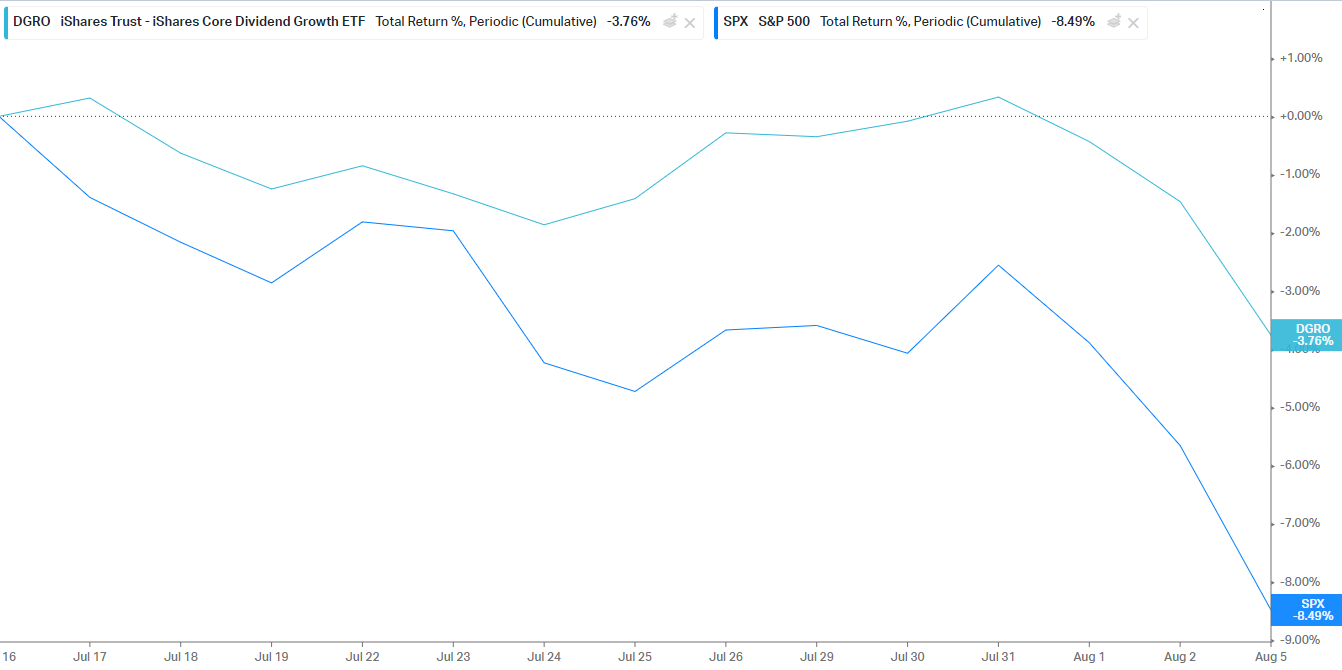

The fund we currently use for this exposure in client portfolios is iShares Dividend Growth Fund, which held up nicely during our recent market pullback:

In the end, we view dividend investing as one of several levers we pull to bring in diversification benefit to client portfolios (we don’t put all your eggs in one basket).

If you want to talk to me about your portfolio, you can use this link to schedule a time to talk.

(1) When companies grant stock to their employees (e.g., Restricted Stock Units, or RSUs), that stock is manufactured out of thin air. To avoid diluting the shares that existed before the new stock grants, the company must buy back some shares to keep the number of outstanding shares the same as before.