The longer you hold onto stocks, the higher your probability of experiencing positive performance. Before I delve into the rosy side of owning stocks, let me start with the [sometimes] bitter aspect of owning stocks.

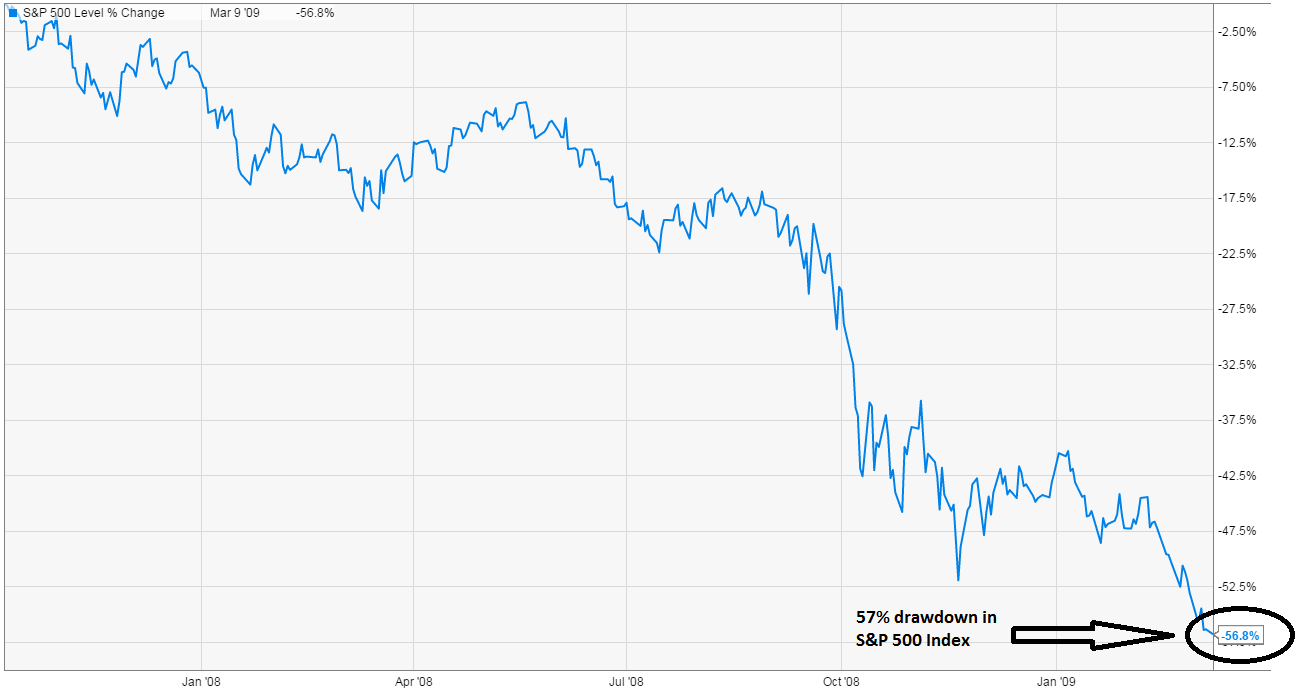

Any single calendar year can be a frightening experience, such as the 39% decline suffered by the S&P 500 Index in 2008. Worse still, the peak-to-trough decline in the S&P 500 Index was 57% (chart below).

To illustrate that in dollars, a 100% stock investor with a $1,000,000 portfolio in October 2007 would have been left with just $430,000 in their portfolio in March 2009 (based on price return of S&P 500 Index).

What if that investor happened to be in retirement, drawing 4% per year of their portfolio to meet living expenses? During that 17-month stretch from 10/2007 to 3/2009, that person would have needed around $55,000 of distributions from the portfolio, meaning their total portfolio could have drawn down even lower.

The lesson: for a time-frame of less than 5 years, stocks can be very volatile (i.e. risky).

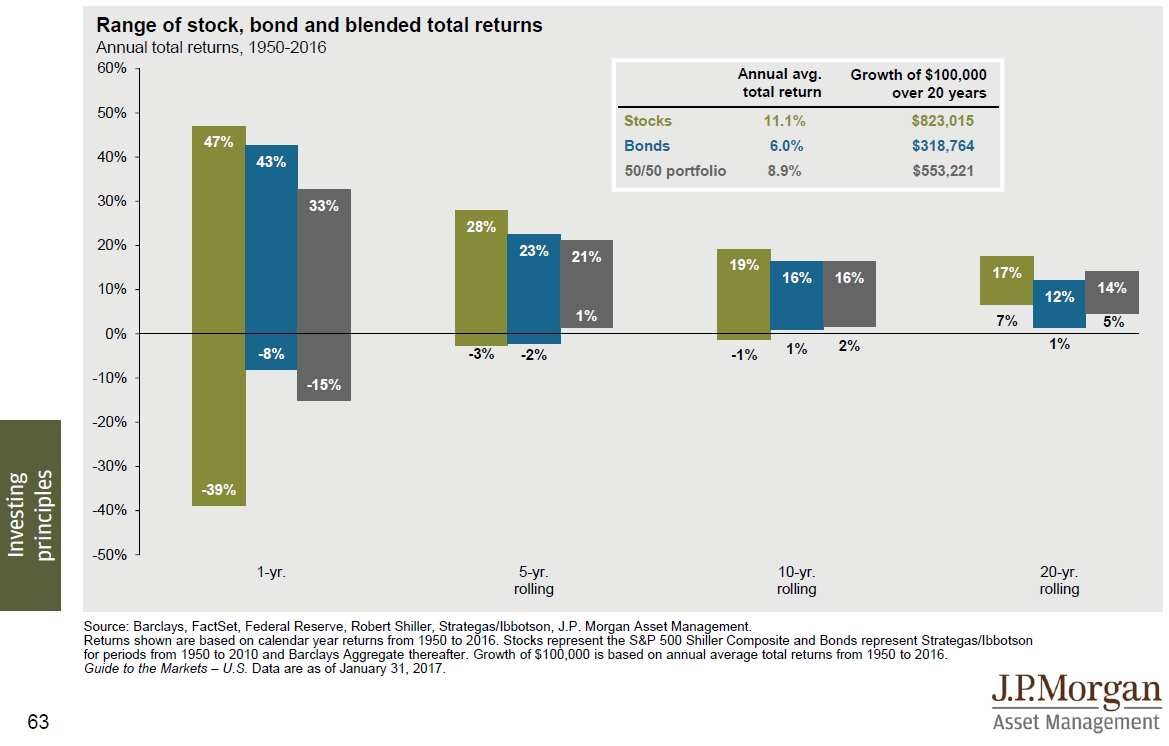

With the medicine now swallowed, let’s review the upside of owning stocks for the long run. When reviewing every single historical 20-year rolling period since 1950, the range of annualized returns for owning 100% stocks is anywhere from 7% – 17%. Even a 50% stock and 50% bond portfolio has a range from 5% – 14%.

The lesson is a clear one: the longer you stay the course with stock investing, the more the deck is stacked in your favor.