Ah, market timing. The holy grail of investing, right? If I can see the next big crash coming, I can avoid steep losses and thereby grow even wealthier. It sounds great, but it really is a fool’s errand.

A handful of clients have recently asked for our prediction of what stocks will do following this election. We know that if a small number of clients are verbalizing this concern, then likely more of our clients privately have similar questions or concerns about the markets.

When asked questions about where the stock market is headed in client meetings, Austin typically explains that his crystal ball is a bit murky at the moment. While he says that in jest, the reality is that we simply do not know where the various global markets will be 12 months from now. However, we do know that over any 10 year period in history, patient, diversified US investors have made money.

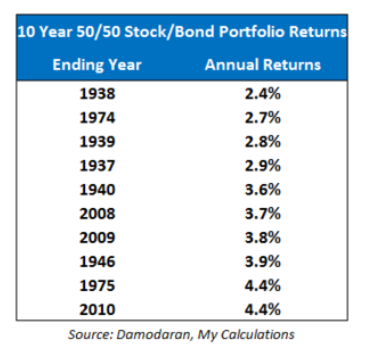

To prove it, let’s look at the historical data from some of the worst 10-year periods in US stock market history. We will utilize the research of Professor Aswath Damodaran of New York University, along with calculations derived from Damodaran’s data by Ben Carlson, an insightful portfolio manager in New York.

The investment performance below displays the ending, annualized rates of returns over 10 years for a simple portfolio. The portfolio is 50% stocks (S&P 500) and 50% bonds (10-year Treasury bonds); the portfolio is rebalanced annually back to that asset mix.

This is remarkable, really. During the Great Depression, the stock market experienced a top-to-bottom decline of about 86%, from 1929 to 1932. Yet, those that stayed the course in a 50/50 stock/bond portfolio would have exited those ten years (1929-1938) with annual returns of 2.4%. I grant that 2.4% per year is crummy, but considering it was the worst stock market experience in US history, those returns are encouraging.

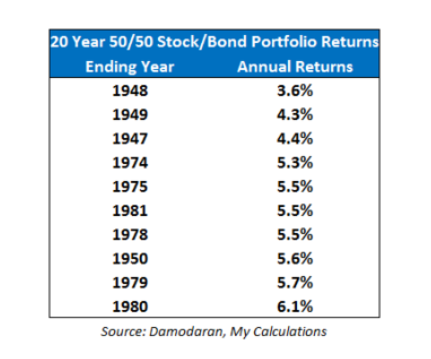

Carlson then ran the same exercise over 20 year periods, with even more encouraging results:

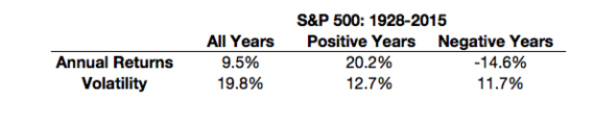

Okay, so we know that long-term returns should be acceptable, at the very least. But what about any given calendar year?

- From 1928-2015, the annual return of investing in the S&P Index was 9.5%.

- Over that time period, over 73% of the years had positive returns. (64 out of 87 years ended the year up).

- Foreign stocks, as measured by the MSCI EAFE Index from 1970-2015, also happened to average a 9.5% annual return.

- Foreign stocks were up in 70% of those years (32 of 46 years)

I’ll gladly take a batting average of over .700 to be a stock investor. It pays to invest in stocks.

Sources:

1) Professor Damodaran’s data.

2) Ben Carlson’s post on 50/50 portfolios.

3) Historic bear markets.

4) Ben Carlson on historical calendar year performance.