I’m quick to admit that owning – and holding – stocks is not easy.

I’ll never forget the moment a close family member (who shall remain nameless) told me in August 2011:

“I never want to own stocks again. Get me out of stocks – completely.”

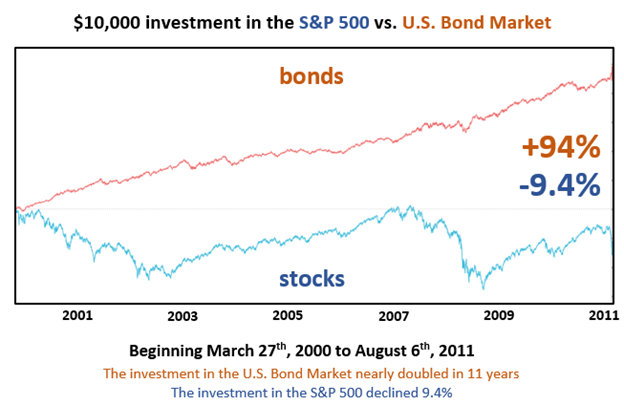

His exasperation with stocks was understandable – at that time. Stocks had delivered negative annualized returns for more than 11 years at that point; the so-called “Lost Decade” for US stocks.

- The S&P 500 Index peaked at 1,552.87 in the spring of 2000, and it closed at 1,119.46 on August 6, 2011. That’s a 28% decline (excluding dividends) over an 11-year + period. Ouch.

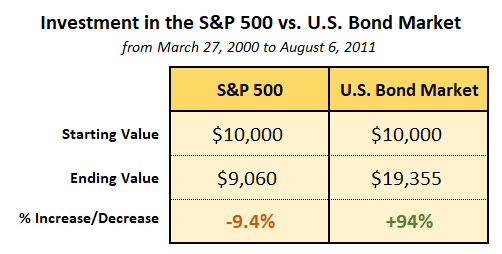

- Even with dividends included, a $10,000 investment in the S&P 500 Index on March 27, 2000, declined to $9,060 on August 6, 2011. It’s hard to imagine holding an investment for 11 years, only to have less money at the end than when you began.

- Conversely, a $10,000 investment in US bonds during that period would have nearly doubled to $19,355. Bonds sure looked attractive at that time.

While I can’t answer those questions, I do look for charts that will give me courage to remain an equity investor. As the presidential election looms, some of our clients have expressed angst about their portfolios.

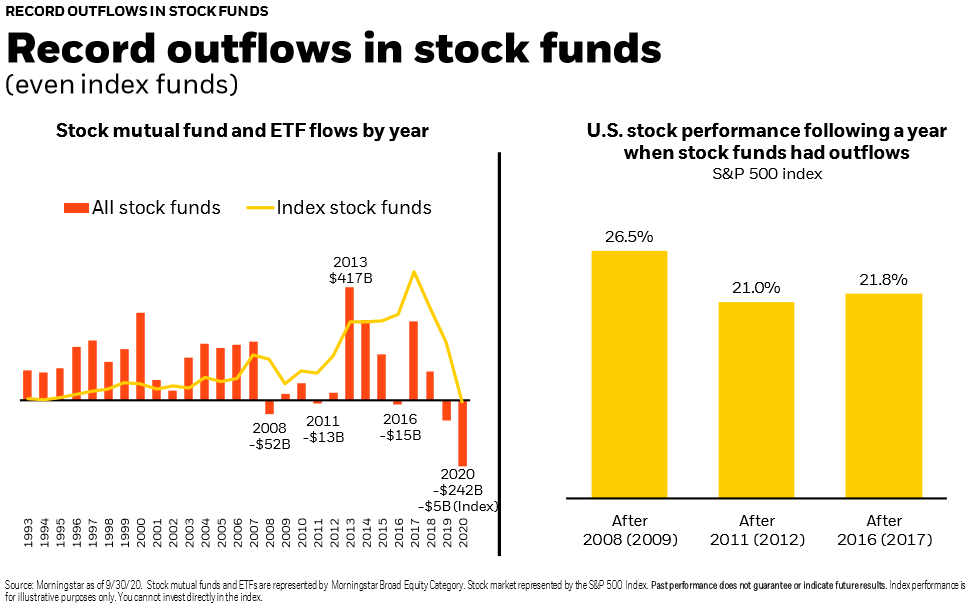

One of the most commonly-cited sentiment gauges is fund flows. Is money flowing out of stocks or into stocks?

Thus far in 2020 (through 9/30), a record $242 billion has flowed out of stocks. In the past, large outflows from stocks have been a contrarian signal of future good performance from stocks.

The usual caveats apply: no signal is perfect nor anywhere near 100% accurate. This time could be different. Nonetheless, it’s clear that investors are not in a greed-fueled state, pouring money into stocks. If anything, there is a lot of skepticism about equity markets right now – which is a good thing.

Regardless of the presidential election outcome – and regardless of how the coronavirus situation evolves – great companies in the US and abroad will continue to offer great products and services. Let’s drill down inside the US stock market to highlight some of these amazing companies:

Investing in the stock market means owning slices of these companies (and thousands more!) that are innovating each day!

P.S. Hat tip to C.S. Lewis for the title of this post.

Sources:

1) www.koyfin.com

2) https://www.spglobal.com/spdji/en/

Disclosures:

Because The Wealth Group, Austin B. Colby & Associates is independent of Raymond James, the expressed written opinions above are our own and not necessarily reflective of Raymond James’ opinions.

This commentary on this website reflects the personal opinions, viewpoints and analyses of the team members providing such comments, and should not be regarded as a description of advisory services provided by The Wealth Group or performance returns of any client of The Wealth Group.

The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person.

Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation.

Individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary. Past Performance does not guarantee future results.