The Secure Act 2.0 was signed into law on December 29th, 2022. SECURE stands for “Setting Every Community Up for Retirement Enhancement”.

While the bill itself is not easy reading, it is important to understand the direct ways in which the legislation affects TWG clients. Below are a few provisions from the bill that impact many of the client families that we serve.

For clients who are in or near retirement:

The biggest change is the age of required minimum distribution (RMD).

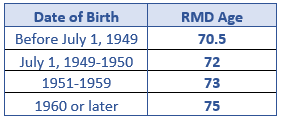

An RMD is simply a forced distribution from your pre-tax accounts (dollars on which income tax has never been paid). Based on your birthdate, you can use the table below to determine your RMD age:

- You have likely heard your Wealth Group advisors emphasize the importance of planning how your dollars will be taxed in the future. With RMD ages increasing, it leads to more planning opportunities for our clients with larger pre-tax accounts (such as Roth conversions). Rest assured, we are all over this for our clients — you will hear more about such opportunities at your upcoming planning meetings.

For our clients approaching retirement, another benefit of the SECURE Act 2.0 is increasing catch-up contributions to retirement accounts:

- IRA catch-up contributions will now be indexed to inflation, as opposed to a flat $1,000. Catch-up contributions are allowed beginning in the year you turn 50.

- Beginning in 2025, individuals aged 60 through 63 will be able to make catch-up contributions of up to $10,000 annually in their workplace plans. This is a notable increase from the catch-up contribution in 2023 of $7,500.

- Note: For individuals who earned more than $145,000 of income in the prior calendar year, all catch-up contributions will need to be made to a Roth account in after-tax dollars.

- For clients over age 50 earning an income, this is a great way to continue turbo-charging your retirement portfolio.

Retirement account contribution limits have also increased for 2023 (note that catch-up amounts are in addition to the limits below):

For our client families with children:

One of the most notable changes presented by the new legislation is the ability to roll over 529 dollars to a Roth IRA tax-free. Parents can now choose to roll over unused dollars in a beneficiary’s 529 account to continue growing tax-free in a Roth IRA. In order to take advantage of this provision, the following criteria must be met:

- The plan must have been open for at least 15 years.

- Rollovers must not exceed the $35,000 lifetime limit.

- Contributions made in the last five years will not be eligible for rollover.

For clients who are currently accumulating wealth:

Beginning in 2024, small business owners and their employees may begin contributing to SIMPLE or SEP IRAs with Roth (after-tax) dollars. This is an advantage to individuals who want to save after-tax dollars in an investment vehicle that allows tax-free growth and withdrawals.

Individuals can now choose to have employer matching contributions be directed to their Roth workplace accounts, allowing more dollars to grow tax-free. The contributions will be added to the employee’s taxable income in the year that they are made.

Another allowance beginning in 2024 is the ability for companies to match employees’ student loan payments with retirement contributions. For example, if an employer offers a 4% match for an employee’s 401k, they will now have the ability to contribute that 4% if the employee puts at least 4% of their income toward student loans, even if no 401k contributions are made. This is a benefit to those who would otherwise delay retirement savings while focusing on debt payoff.

The Wealth Group team is constantly monitoring legislative and tax law changes, seeking out ways to help our clients minimize taxes and grow their net worth. Our team is always available to discuss further details of the SECURE Act 2.0 and how it may affect you and your unique planning opportunities.