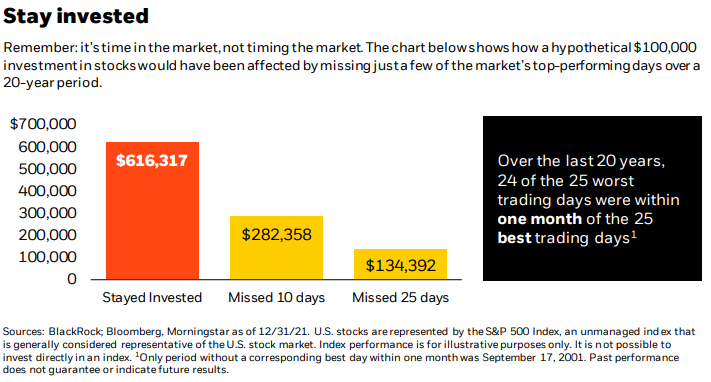

There are about 253 stock market trading days per year. Over 20 years, that equates to 5,060 trading days. If you missed the 10 best days out of those 5,060, you only missed 0.2% of all the trading days (one-fifth of one percent). You missed 1 out of every 506 trading days, or 1 day every two years.

You were invested 99.8% of the time in the stock market. And yet your returns would have been reduced by more than 50% from missing those crucial best days.

If your mind works like mine, you want to have your cake and eat it too. You are willing to miss some of those best days — if it means you also miss the worst days. Lo and behold, the great days are clustered chronologically near the crummy days. You can’t get one without the other.

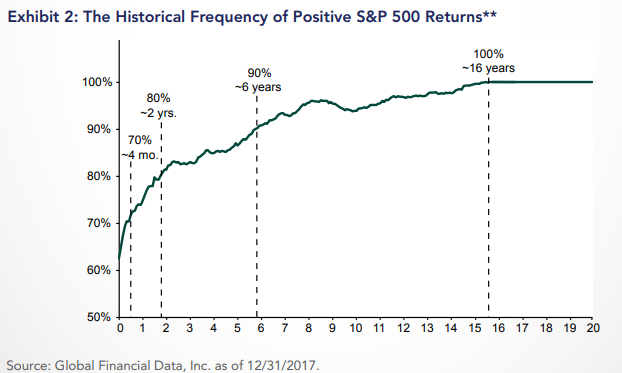

In a perfect world (and a completely unrealistic world), we would all check on our portfolio values once a year — or once every two years. By doing so, our odds of being pleased with the value would be much greater.

If you only looked once every two years, your US stocks would be higher in 80% of those instances.

With that said, the stock market declines aren’t easy to stomach. If investing in stocks was easy, the returns we all earn would be lower due to fewer people selling out. Hopefully, the next time the TV anchor or newspaper writer is telling you the sky is falling, you can remember that bull markets are born out of bear markets, and patient investors are well rewarded in the long run.