When investing in US stocks, the longer your time horizon, the better your odds of success.

Most of us know that intuitively, but following through on head knowledge with actual life choices is another matter.

When the stock market is cascading downward, our brains can go into preservation mode: “Make the bleeding stop!” Thinking long-term during these moments is an acquired skill; most of us don’t naturally possess the fortitude to not be distraught over declines in our wealth. Those who do possess that fortitude are what we call engineers (that is only partly a joke).

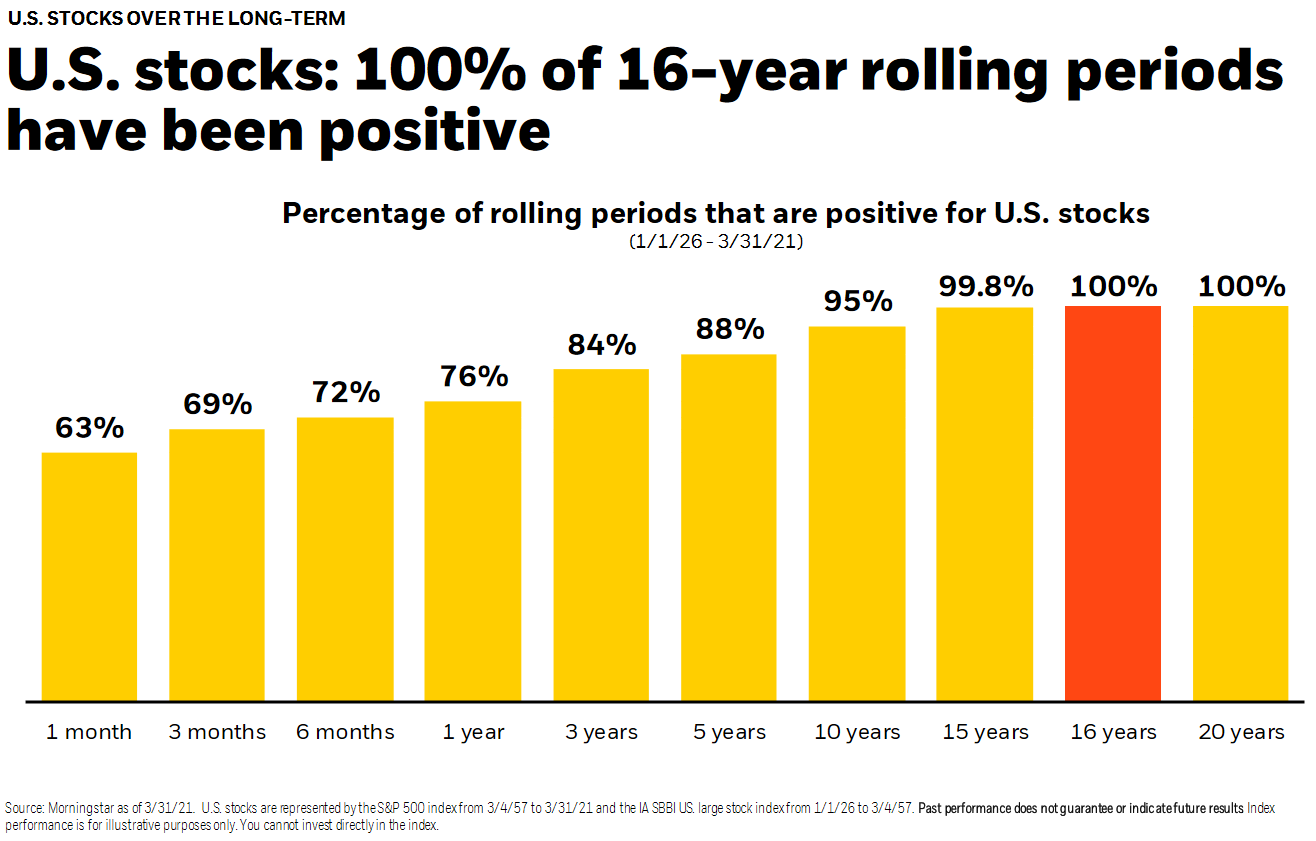

Dating back to 1926, US stocks have never experienced a negative cumulative return over any 16-year period (including the Great Depression).

Can you stick with your stocks for 16 years?

Many of our clients end up being stock investors for 60 or even 70 years of their lives. These clients have faced multiple prolonged bear markets during their years as investors. What’s 16 years compared to 70 years of investing?

But, we recognize that life doesn’t neatly transpire in rolling 16-year periods. In March 2020, when stocks had precipitously dropped 35% in the span of a few weeks, would it have been any comfort for me to tell clients, “I know this is painful, but if you can hang on to your stocks for another 15 years and 11 months, history gives us a 100% probability of your portfolio getting back to even.” That would not have been any comfort at all.

With that said, let’s look at the shorter time periods on the chart. The idea that you have a “win rate” of 72% over any 6-month period is quite impressive.

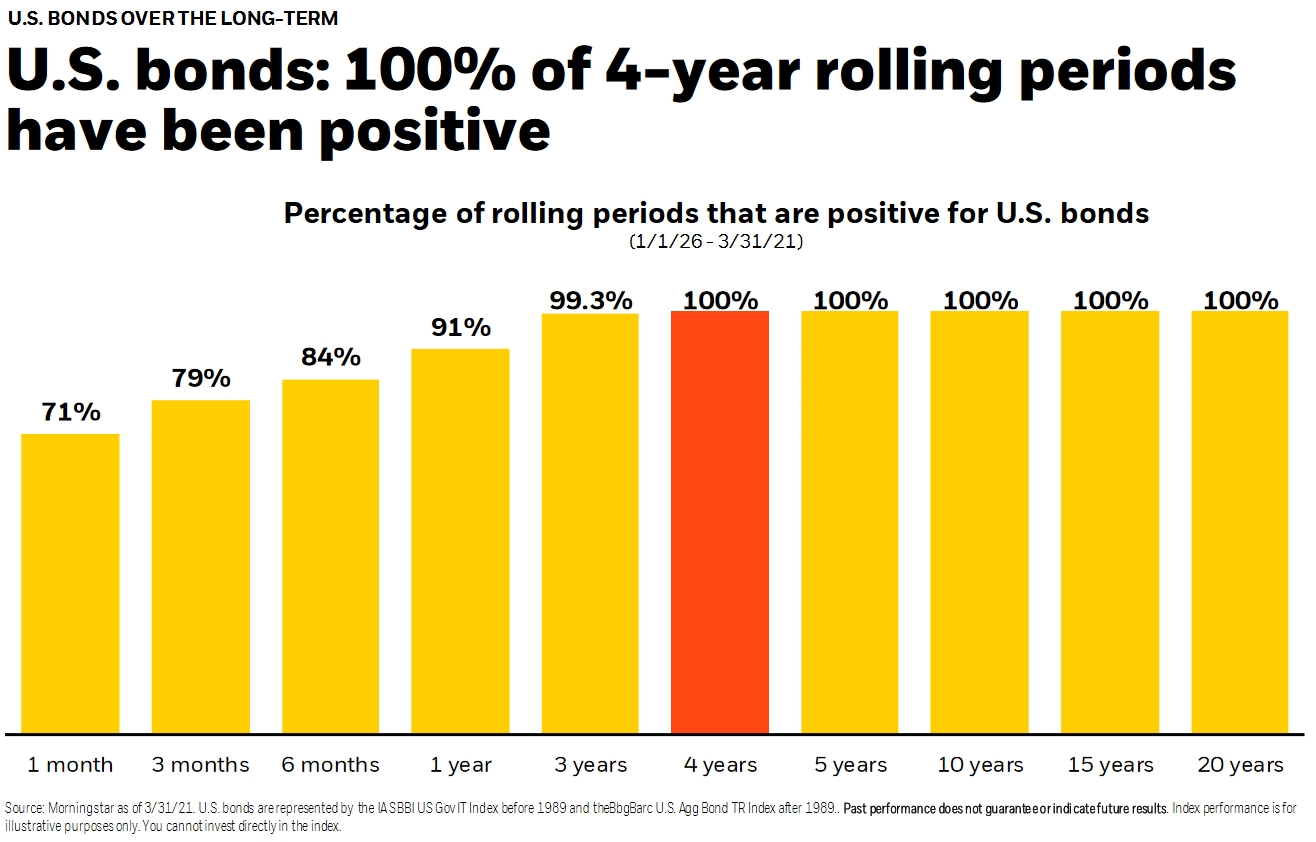

What about our clients in retirement who can’t wait 16 years for stocks to turn positive? This is where bonds come in.

During stock market drawdowns, bonds have historically either maintained or increased their value. When stocks are selling off, we utilize our clients’ bond holdings to fund their ongoing withdrawals from the portfolio.

What does this mean to you, our client?

Stocks have historically been a fantastic method for growing wealth, but with that growth comes some serious declines along the way. We are here to help our clients build diversified, balanced portfolios that stand the test of time — and to help our clients fend off the urge to sell when their chips are down.

Disclosures:

Because The Wealth Group, Austin B. Colby & Associates is independent of Raymond James, the expressed written opinions above are our own and not necessarily reflective of Raymond James’ opinions.

Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. The information contained in this post does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance may not be indicative of future results. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise.