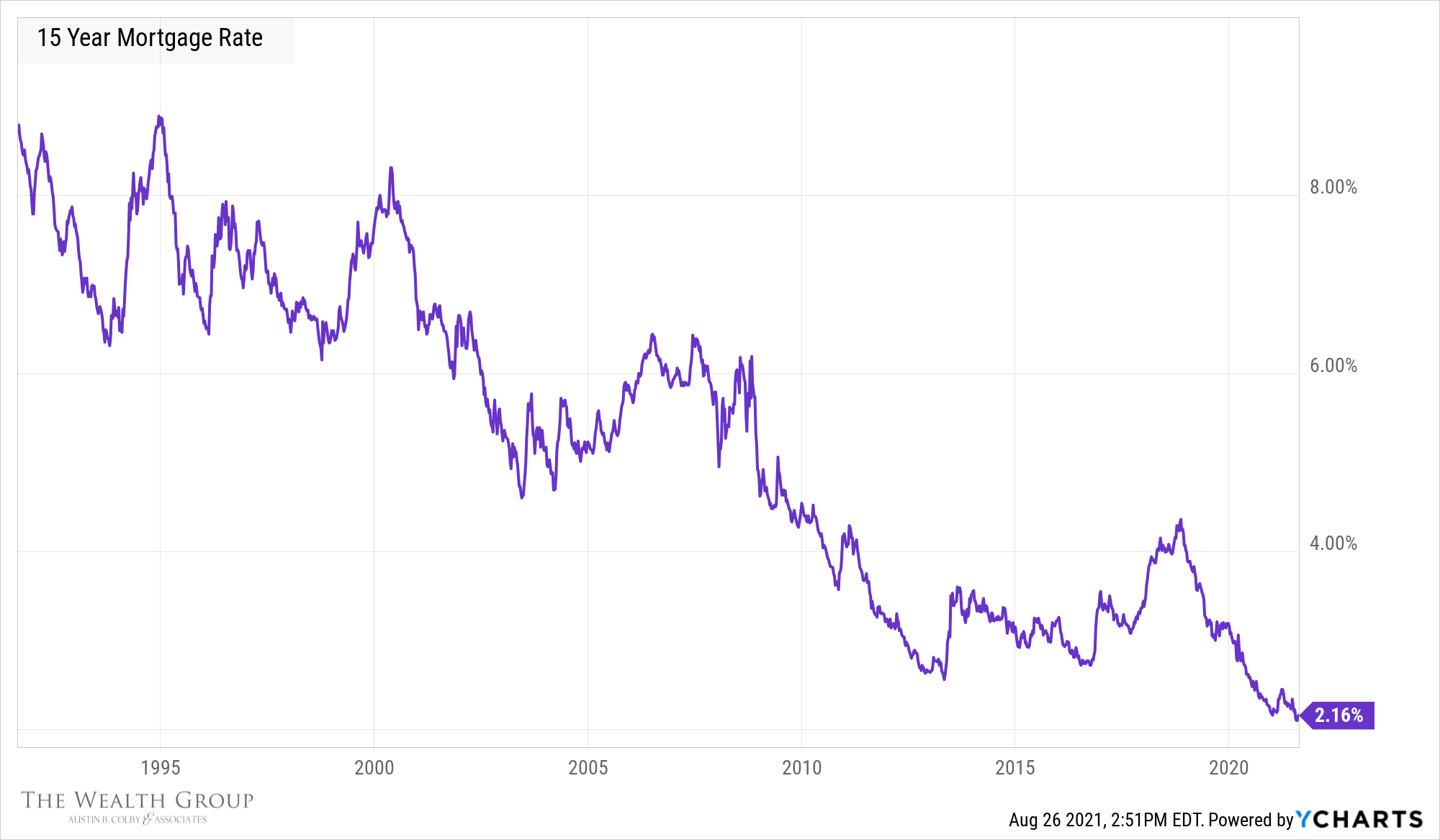

Mortgage rates are once again at their lowest point in US history:

The perennial question we get from clients is whether to own their home with cash or keep a mortgage long-term. “If I can earn 7%, 8%, or even 9% annually from my investment portfolio, don’t I want as much money invested as possible?”

Mathematically, this is true. If you can borrow money at 2% (against an appreciating asset) and invest money at 7-9%, it’s a good deal. Right?

Maybe.

Our never-changing advice is always to get 100% of your debt paid off as quickly as possible.

Our advisors here at TWG love stock investing as much as anyone, so we get the intrigue of keeping low-interest-rate debt to keep more money invested. Yet that does not keep us from simultaneously seeking to pay off our mortgages as quickly as possible. The most widely-viewed blog post we’ve written was the story of team member Adam Colby being mortgage-free by age 43.

Every team member here either has zero mortgage debt or is in a 10-year or 15-year mortgage. Most of us are paying extra on our mortgages to get them paid off even faster. My wife and I are currently refinancing into a new 10-year mortgage, with a goal of paying some extra on that to become debt-free sooner.

Here are our 5 additional thoughts on owning real estate with 100% cash:

1) The danger with low mortgage rates is the temptation they bring to stretch your budget (and I am not personally immune to this temptation!). By taking on a 10-year or 15-year mortgage, your perception of “affordable” shifts, as the monthly payments on those loan terms are much higher than on a 30-year. Some of our clients find a middle ground in a 20-year mortgage.

Think of new vehicle purchases, where dealers will often offer interest-free financing. If I’m earning 8% in my investment portfolio, why not finance 100% of my vehicle purchase — thereby enabling me to keep all of that money working and earning in my portfolio?

It’s because I’m better off in a $35,000 vehicle (paid for with cash or even partially financed) than a $70,000 vehicle that is financed at 0%. The key here is not letting the financing become a distraction from total dollars spent. This is particularly true with a depreciating asset like a vehicle, but the logic holds with real estate, too.

2) It just feels good to not owe money to anyone.

The psychological benefits of being 100% debt-free are real — and they are worth a lot.

3) Begin with the end in mind.

Most of our clients aim to have no mortgage in retirement. If that’s your goal, why not get there as quickly as possible? We have advocated in the past for getting your mortgage paid off by age 45.

And if that is not your goal, why not refinance into a new 30-year mortgage every few years — for the rest of your life?

4) Having zero mortgage debt puts you on the fast track to building a meaningful after-tax investment account.

One of the top predictors of wealth creation is having sizable assets invested in an after-tax investment account (also referred to by the following terms: non-qualified account; brokerage account). The best way to build such an account is to have no mortgage. When you have no mortgage going out each month, you have that extra cash available to invest $1,000 – $3,000 (or more) per month into an after-tax investment account.

5) Cash-flow is king.

By eliminating your mortgage payment, you have one less fixed, recurring outflow each month. This means your monthly spending is lower. And when your monthly spending is lower, you are able to keep more money invested in your portfolio. During your accumulation years, no mortgage means adding more each month to your portfolio (see #4 above). During your distribution years (retirement), you are able to draw less each month off your portfolio — leaving more money in your portfolio to grow.

The Wealth Group is here to help our clients be able to make their debt-free scream — as quickly as possible. To schedule a quick 15-minute call with me to discuss your finances, click here.