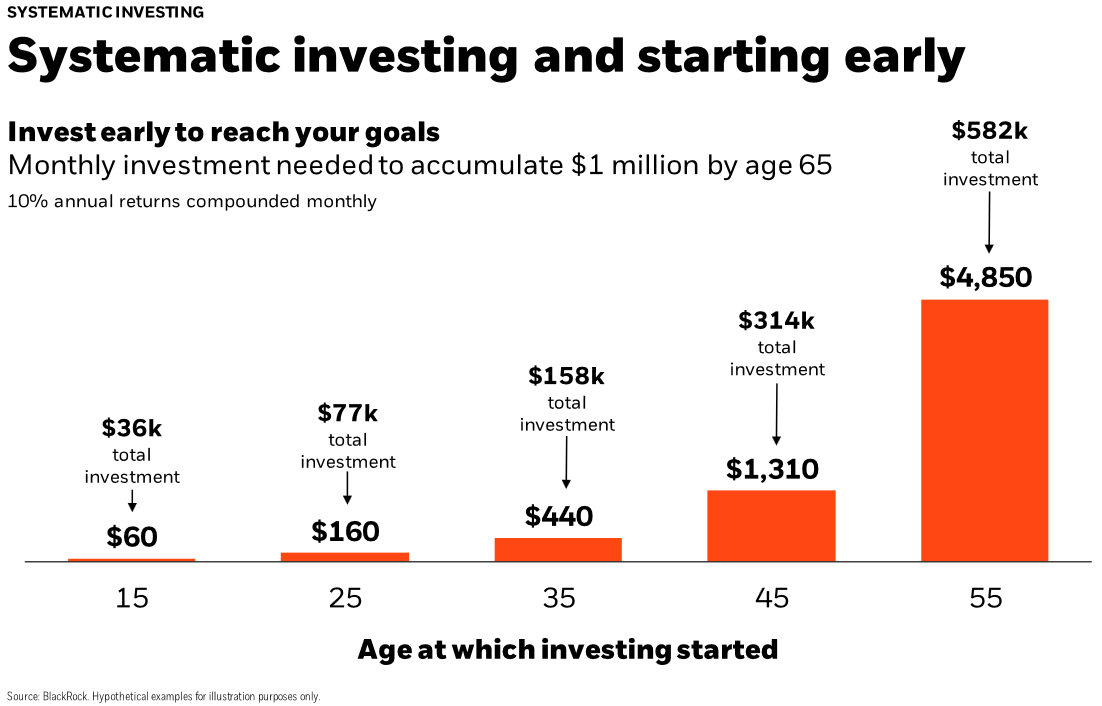

Everyone knows you should start investing as young as possible. But not many people actually start investing at a young age. So how can we get this message into the minds and hearts of our children and grandchildren? My oldest child is just 6, so I’ll have to report back to you in about 15 years on whether our family has any success in this arena.

The challenge lies in converting an abstract and vague statement (“get started investing while you are young”) into a concrete statement – accompanied by a visual representation. Here’s my crack at it.

Investing for the first time at age 45 requires eight times as much effort as starting at age 25.

Maybe a 10% annual return assumption is too optimistic, but even if you use 8% returns or some other figure, the message still stands: it’s much easier to build wealth when you start young.

Okay, so that’s the data. No one can argue with that. So how do we get there? And where are the common pitfalls along the way? Read on for some practical tips to help young people get started investing.

1) The minute a child begins earning income, they should start investing. Even if it’s your 12-year old daughter earning $10/hour at a babysitting job, it’s time to get some money invested — a custodial account (UTMA) is a great place to do this. Mom and Dad can fund the account with their own money, or you can have a “matching program.” For example, for every 25 cents the child invests, Mom and Dad kick in one dollar (you can choose whatever ratio you want).

2) Think carefully about vehicle purchases for your 16-year old. I’ll tread carefully here, but consider that a $15,000 – $20,000 vehicle purchase for a teenager carries a tremendous opportunity cost. What if that $15,000 was set aside in an investment account to help out with your child’s first home down payment? Or better yet, set aside for their future financial security? Lest you think a child needs a $15,000 vehicle to “be safe”, recall that I drive a 2007 Toyota Yaris with a Blue Book value of around $3,000. Granted, I’ve been looking at the 2021 Tesla Model X, but that’s another story. 😉

Investing $15,000 today is worth $700,000 in 50 years — at 8% annual growth.

3) If the stakes are high on vehicle purchases, they are astronomically high when it comes to the college decision.

4) Consistent investing is the key component. This is what makes 401k’s so profoundly important: they are akin to forced savings.

5) Avoiding shiny new toy syndrome. Whether it’s cryptocurrency, finding the next Tesla/Amazon/Netflix, rental real estate, taking on student loans or car loans, buying penny stocks you heard about on Reddit, or a host of many other potential distractions/impediments, there is great temptation to stray off the path of disciplined, diversified, consistent investing.

Want to review your finances or ask me a question? Click here to schedule a 15-minute phone call/Zoom with me.