My family has been considering a move at some point in the near future (my wife and I have different definitions of the word “near”).

Like many red-blooded Americans (the American Dream and all), I get tempted by the listings that are “just” out of our price range. Before you know it, the “budget” has quietly increased by $50,000 or $100,000 (or more).

But also like many Americans, I don’t want to be “House Poor” (or Big Hat, No Cattle)–where your home mortgage is hindering your capacity to meet crucial long-term financial goals.

Setting aside the issue of budget creep, how do I figure out what our price range should be?

Your mortgage lender will give you a budget that will always be higher than what is prudent for your financial situation. And, they will always quote you a 30-year mortgage rate – unless you specifically ask for a 15-year or 20-year mortgage quote.

[side note / caveat: we recognize that rising home prices and rising interest rates have made 15-year mortgages even more challenging to afford.]

From a financial planner’s perspective, the simplest way to budget for a new home is to “practice” a higher mortgage payment right now.

Hypothetical scenario:

- A family is currently paying $2,500/month (all-in: principal, interest, property taxes, and homeowner’s insurance).

- The level of home they want would lead them into a total mortgage payment of $4,500/month (for a 15-year mortgage, including taxes and insurance).

- To practice making that $2,000/month of an additional payment, the family has two great options:

- Log-in to their current mortgage website and automate an additional monthly principal payment of $2,000–and zealously maintain that payment level (don’t lower it).

- Automate a $2,000 monthly addition to a joint investment account (a non-retirement account, which some folks call a “brokerage” account or an “after-tax” investment account).

By doing this, the family can stress-test whether they could handle a $4,500/month housing payment.

We recommend trying to get at least 6 months or longer of successfully doing this before making the big decision of buying a new home.

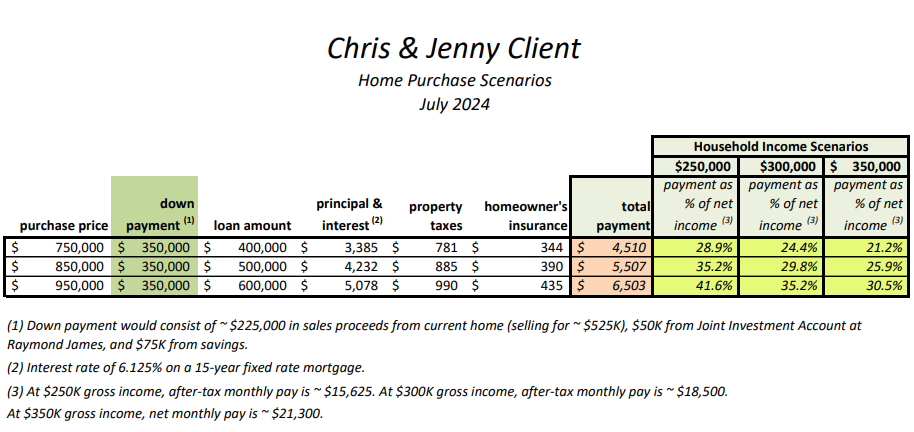

The Wealth Group team guides our clients through this process. We want to help our clients feel peace about their home-buying decisions. A sample of our home purchase scenario spreadsheet is below.

P.S. Much like a preacher needing to heed his own sermons (preaching to himself), we at TWG also aim to practice what we preach! This post was a good reminder for my own family finances and home search.